The toll is the amount of taxes to be paid for using the National Highways but there are certain Toll Exemption In 2026 which can be availed by eligible beneficiaries. There will now be some Toll Exemption in 2026 and out of that 2 wheelers are exempt from the toll tax payment. The electric vehicles shall also not make the toll tax payment. The changes are towards the improvement of the traffic flow and it saves the commuters and the businesses. Who Is Exempted To Pay Toll Tax 2026 have been mentioned here in the article and some states levy toll taxes on two wheelers also. Now the complete facts on the exemptions are to be checked through the article here mentioned below.

Toll Exemption In 2026

The National Highway Authority of India has provided the best Highway roads for the citizens and they have been charging the taxes in return from the users in the form of toll. The Indian Government has now announced significant changes to the toll tax system which has been effective from 2026. The new changes have been implemented for the smooth implementation of transportation and the revisions are towards the improvement of the traffic flows and to reduce the congestion on the highways. The highways charge a different amount of toll taxes and since 2021, the Fastag installation has become mandatory for all. There have been certain vehicles who are not to pay the toll taxes as per Toll Exemption In 2026.

With the implementation of changes, the Government hopes to encourage the use of vehicles which contribute less towards pollution and provide a relief to certain sectors. Two wheelers are the ones who need not pay the toll tax. The three wheelers like tractors, combine harvesters and others are also exempt from the tax payment towards the toll. Emergency vehicles like ambulances, fire vehicles are also exempt from the toll tax payment. Who Is Exempted To Pay Toll Tax 2026? has been in the question since a long time and the answer to it shall be checked through the post given below.

What Is Toll Tax In India?

The road charge, which is known as the toll, is the tax payment for using the interstate expressways, tunnels and the highways either State or National. In India the entire road system is under the NHAI. NHAI has imposed various rules and regulations which tell the complete collection process. The rules have certain exemption for taxes, rules on how the road charges for the expressway.

Reason For Toll Tax Collection

India has the largest roadway network in the World and the taxes for roads have to be paid so that funds are enough for the repair and maintenance of roads. The paying station is set up on roads and the taxes are collected through them.

Rules For Toll Tax

Following are some of the Rules For Toll Tax Collection.

- The taxes at a particular booth shall be fixed and same for everyone. The rate is as per the vehicle you have.

- The toll plaza can’t be built at any random location rather it has to be constructed in such a way to avoid traffic

- There is a proper tax exemption list which is for emergency vehicles.

- The road charges gets collected at any toll plaza in the Country and it is very important to have the technology in place to collect the taxes in an effective way.

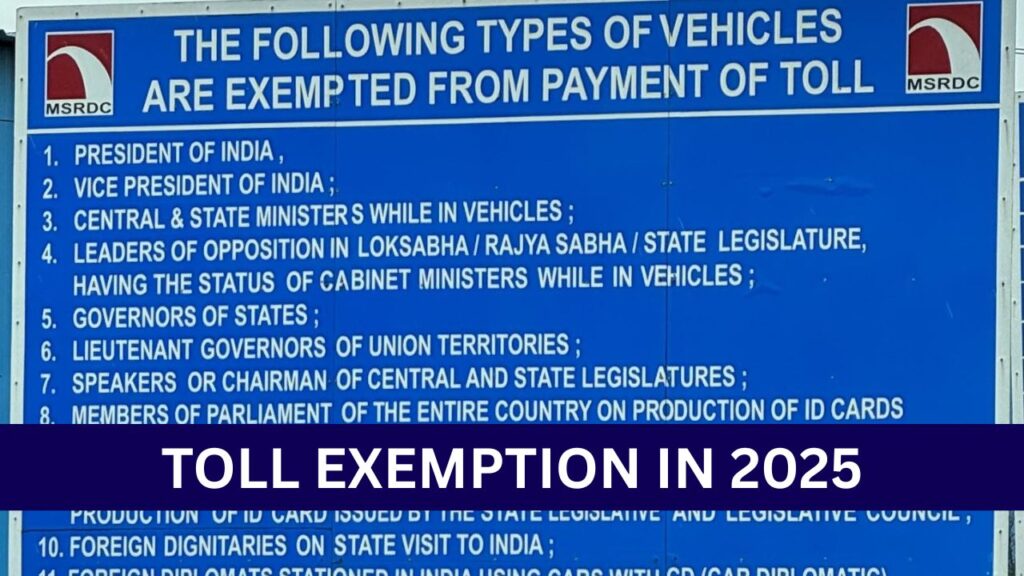

Who Is Exempted To Pay Toll Tax 2026?

- On electric vehicles, there is a full exemption of toll

- In order to promote a mass transit, there is no toll fee for the public transport bus

- Agricultural vehicles used for farming is free from toll payment

- No toll tax on emergency vehicles to ensure smooth operations

- Government vehicles

- Carpooling vehicles

- Hybrid vehicles are partially exempt

- Good vehicles running on cleaner fuel

- VIP vehicles carrying Prime Minister or Chief Minister or other Political parties.

Toll Fees Exemption List 2026

| Vehicle type | Status | Reason |

| electric vehicles | Exempt | Sustainability of environment |

| Public transport bus | Exempt | Affordable commuting |

| Agricultural vehicle | Exempt | Farmers support |

| Emergency vehicle | Exempt | Efficiency in operations |

| Government vehicle | Exempt | Facilitation of service |

| Carpooling vehicle | Discount | Ride sharing |

| Hybrid vehicles | Partially Exempt | Green energy transition |

| Goods vehicle | Reduced toll | Promote clean fuel |

Benefits of Toll Exemption

- Carbon emission reduction

- Reduced traffic queues with increased use of public transport

- Low pollution level

- Encouragement of sustainable practices.

FAQs On Toll Exemption In 2026

The ones who have been travelling through two wheeler are exempt from the tax payment.

The amount charged is the same for all but the only variation is the type of vehicles.

The taxes are collected to ensure that funds are generated for road repair and towards the maintenance.